Being a single mother often means managing financial responsibilities on your own, which can feel overwhelming without the right support.

From daily expenses to long-term goals like housing or education, there are programs designed to ease the burden and provide stability.

This blog covers the most trusted options available, from grants to assistance and housing support, with practical guidance to help you find what fits your situation best.

Loans, Grants, and Assistance Programs

Single mothers often hear about loans, grants, and assistance programs, but they can be confusing. Each one works differently and has its own pros and cons.

When you’re a single mother looking for financial help, it’s important to know the difference between loans, grants, and assistance programs.

- Loans: Money you borrow and repay with interest. Based on credit, income, and loan type.

- Grants: Money you don’t repay. Usually for education, housing, or basic needs.

- Assistance programs: Help with food, housing, healthcare, or utilities. Based on income and family size.

Each option works differently, so choosing the right one depends on your needs and situation.

Government Grants & Financial Assistance

Government aid can make a big difference for single mothers. These programs help with food, housing, healthcare, and education. Since they don’t need to be repaid, they’re often the safest starting point.

1. TANF (Temporary Assistance for Needy Families)

TANF is a federally funded program managed by individual states. It’s designed to help low-income families with children meet their basic needs while supporting them in finding work and moving toward self-sufficiency. Assistance is temporary and comes with work-related requirements.

Eligibility

To qualify for TANF benefits, families must meet certain requirements related to children, income, residency, and participation.

- Children required: Families must have a dependent child under 18 (or 19 if still in school).

- Income limits: Household income and assets must be below limits set by the state.

- Residency: You must be a U.S. citizen or eligible non-citizen and a resident of the state where you apply.

- Participation requirements: Most adult recipients must meet work or training obligations.

2. SNAP (Supplemental Nutrition Assistance Program)

SNAP provides monthly food assistance through an EBT card, which can be used at grocery stores and farmers’ markets for approved food items. The amount depends on household income, expenses, and family size.

Eligibility

To qualify for SNAP benefits, households must meet requirements related to income, residency, and work participation.

- Income limits: Household income and expenses must fall within state and federal guidelines.

- Residency: Applicants must be U.S. citizens or eligible non-citizens living in the state where they apply.

- Work requirements: Able-bodied adults without dependents are generally required to work or participate in job training.

3. WIC (Women, Infants, and Children)

WIC provides supplemental foods, nutrition education, and health referrals for pregnant women, new mothers, infants, and children up to age five. Benefits are given through checks, vouchers, or EBT cards to buy approved healthy foods.

Eligibility

To qualify for WIC benefits, applicants must meet requirements related to category, income, residency, and health risk.

- Category: Must be a pregnant, breastfeeding, or postpartum woman; an infant; or a child under five.

- Income limits: Household income must be at or below state-set limits, usually 185% of the federal poverty level.

- Residency: Applicants must live in the state where they apply.

- Health risk: A health professional must determine a nutritional or medical risk.

4. Medicaid

Medicaid is a joint federal and state program that provides health coverage to eligible low-income individuals and families. It covers services such as doctor visits, hospital care, prescriptions, and preventive health care.

Eligibility

To qualify for Medicaid benefits, applicants must meet requirements related to income, residency, and category.

- Income limits: Household income must fall within state and federal guidelines, often tied to the federal poverty level.

- Residency: Applicants must be U.S. citizens or eligible non-citizens living in the state where they apply.

- Category: Eligibility is typically extended to children, pregnant women, parents or caretakers, elderly adults, and individuals with disabilities.

- Other requirements: Some groups may need to meet additional state-specific rules.

5. Pell Grants & FAFSA for Education

Pell Grants are federal funds that help low-income students pay for college or career school. Unlike loans, they do not need to be repaid. To apply, students must complete the Free Application for Federal Student Aid (FAFSA), which determines eligibility for grants, work-study, and federal student loans.

Eligibility

To qualify for Pell Grants, students must meet requirements related to financial need, enrollment, and education status.

- Financial need: Determined through the FAFSA, based on family income, assets, and other factors.

- Enrollment: Must be enrolled or accepted as a student in an eligible college or career program.

- Education status: Available to undergraduates who have not yet earned a bachelor’s or professional degree.

- Residency: Applicants must be U.S. citizens or eligible non-citizens.

6. EITC (Earned Income Tax Credit)

The Earned Income Tax Credit is a federal tax benefit for low- to moderate-income workers. It reduces the amount of taxes owed and may result in a refund, even if no tax is due.

The credit amount varies based on income, filing status, and number of qualifying children.

Eligibility

To qualify for the EITC, applicants must meet requirements related to income, filing status, and dependents.

- Income limits: Earned income and adjusted gross income must fall below yearly limits set by the IRS.

- Filing status: Must file a federal tax return with a status other than “married filing separately.”

- Dependents: Larger credits are available to those with qualifying children, but some workers without children may also qualify.

- Residency: Must be a U.S. citizen or resident alien for the entire tax year.

7. LIHEAP (Low-Income Home Energy Assistance Program)

LIHEAP helps low-income households pay for heating and cooling costs. It may also cover weatherization, energy-related home repairs, and emergency assistance to prevent utility shutoffs.

Benefits are typically paid directly to utility companies on behalf of eligible households.

Eligibility

To qualify for LIHEAP benefits, applicants must meet requirements related to income, residency, and energy need.

- Income limits: Household income must fall within state and federal guidelines, often set as a percentage of the federal poverty level.

- Residency: Applicants must be U.S. citizens or eligible non-citizens living in the state where they apply.

- Energy need: Priority is often given to households with high energy costs, vulnerable members (elderly, disabled, or young children), or those facing utility shutoffs.

8. Housing Vouchers (Section 8)

The Section 8 Housing Choice Voucher program provides rental assistance to low-income families, seniors, and people with disabilities. Vouchers cover part of the rent, and participants pay the remaining amount directly to the landlord.

The program allows families to choose safe and affordable housing in the private market.

Eligibility

To qualify for Section 8 housing vouchers, applicants must meet requirements related to income, residency, and family status.

- Income limits: Household income must be at or below 50% of the area median income, with priority often given to those at 30% or below.

- Residency: Applicants must be U.S. citizens or eligible non-citizens and reside in the area where they apply.

- Family status: Available to families with children, seniors, and individuals with disabilities; single individuals may also qualify.

- Other requirements: Applicants must pass background checks and cannot have certain criminal or eviction histories.

9. Child Tax Credit (CTC)

The Child Tax Credit helps families with children by reducing the amount of federal income tax they owe. In many cases, it can also increase your tax refund. For single mothers, this can be a valuable source of extra money each year.

Eligibility

To qualify for the Child Tax Credit, you must meet requirements related to income, dependents, and filing status:

- Dependents: Must have a qualifying child under age 17.

- Income limits: Credit begins to phase out at higher income levels set by the IRS.

- Filing status: Must file a federal tax return; credit amounts vary based on whether you file as head of household or single.

- Residency: The child must live with you for more than half the year and be a U.S. citizen or resident alien.

The exact credit amount can change each year, so it’s important to check current IRS guidelines when you file taxes.

How to Apply and What You Need

Most programs require an application through your local social services office or the program’s website.

Be ready to provide:

- Proof of income: Pay stubs, tax returns, or benefit letters.

- Identification: For yourself and your children.

- Proof of residency: Lease, utility bill, or official mail.

- Social Security numbers or ID numbers: For all household members.

Having these documents ready makes the process faster and improves your chances of approval.

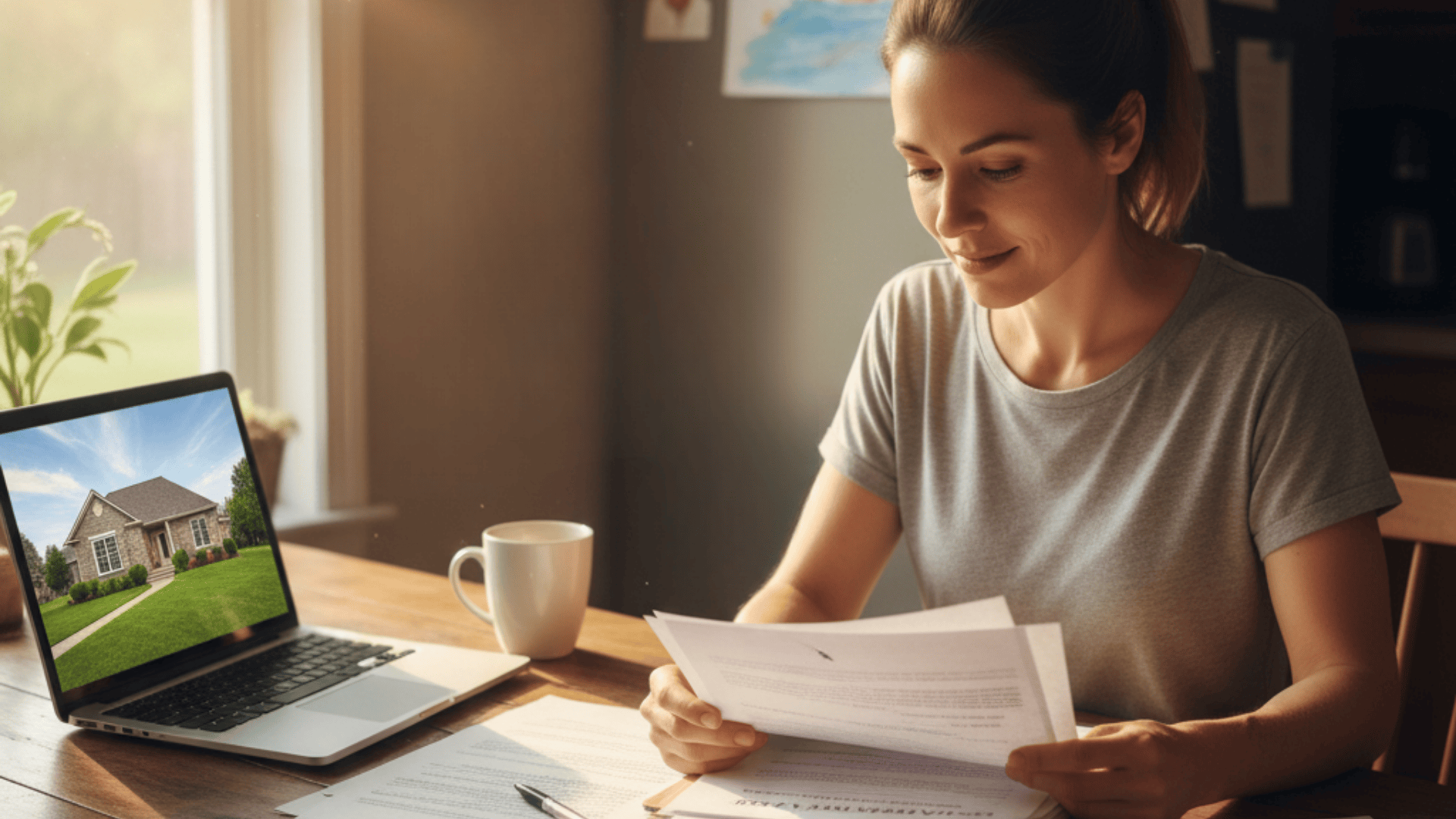

Housing Loans and Homeownership Programs

Owning a home as a single mother can feel out of reach, but several loan programs and housing options make it possible. These programs are designed to lower costs and offer flexible requirements.

1. FHA Loans

FHA loans are government-insured mortgages offered by approved lenders and backed by the Federal Housing Administration.

They are designed to help first-time buyers and low- to moderate-income households qualify for homeownership with lower credit and down payment requirements.

Eligibility

To qualify for an FHA loan, applicants must meet requirements related to credit, income, property, and residency.

- Credit score: A minimum score of 580 is needed for a 3.5% down payment; scores between 500–579 may qualify with 10% down.

- Income limits: No strict income caps, but borrowers must show stable income and meet debt-to-income ratio guidelines.

- Property requirements: The home must be the borrower’s primary residence and meet FHA safety and livability standards.

- Residency: Applicants must be U.S. citizens or eligible non-citizens with valid Social Security numbers.

2. USDA Loans

USDA loans are government-backed mortgages offered through the U.S. Department of Agriculture’s Rural Development program.

They are designed to make homeownership more affordable for low- to moderate-income households in rural and certain suburban areas.

Eligibility

To qualify for a USDA loan, applicants must meet requirements related to location, income, property, and residency.

- Location: The property must be in a USDA-approved rural or suburban area.

- Income limits: Household income must be at or below 115% of the median income for the area.

- Property requirements: The home must be used as the borrower’s primary residence.

- Residency: Applicants must be U.S. citizens or eligible non-citizens.

3. VA Loans

VA loans are government-backed mortgages offered through the U.S. Department of Veterans Affairs. They are designed to help veterans, active-duty service members, and certain surviving spouses buy, build, or refinance a home with favorable terms.

Eligibility

To qualify for a VA loan, applicants must meet requirements related to service, property, and residency.

- Service: Must be an eligible veteran, active-duty service member, member of the National Guard/Reserves, or surviving spouse meeting VA guidelines.

- Credit and income: No strict credit score requirement, but lenders typically look for stable income and responsible credit history.

- Property requirements: The home must be used as the borrower’s primary residence and meet VA minimum property standards.

- Residency: Applicants must be U.S. citizens or eligible non-citizens.

4. Down Payment Assistance (DPA) Programs

Down Payment Assistance programs help homebuyers cover the upfront costs of purchasing a home, such as the down payment and closing costs.

These programs are typically offered by state or local housing agencies, nonprofits, or employers, and can come in the form of grants, forgivable loans, or deferred-payment loans.

Eligibility

To qualify for DPA programs, applicants must meet requirements related to income, property, and residency.

- Income limits: Household income must usually fall within state or local program guidelines, often based on area median income.

- Property requirements: The home must typically be the buyer’s primary residence and fall within program price limits.

- First-time buyer status: Many programs require applicants to be first-time homebuyers, though some allow repeat buyers.

- Residency: Applicants must be U.S. citizens or eligible non-citizens and often must purchase in the state or locality offering the program.

Personal Loans for Single Mothers

Sometimes, grants or assistance programs may not cover every need, and personal loans become an option. While they can provide quick access to funds, it’s important to understand the main types, their benefits, and the risks involved before making a decision.

Bank and Credit Union Loans

These are often the safest personal loan options if you have a steady income and a good credit score. They usually come with lower interest rates and more favorable repayment terms than other lenders.

Borrowing from a bank or credit union can make repayment more predictable and manageable over time.

Online Lenders

Online lenders make applying for loans fast and convenient, with many offering same-day or next-day funding. They are a good option if you need money quickly.

However, rates and fees can be higher compared to traditional banks, so it’s important to compare multiple offers before accepting one.

Installment Loans

An installment loan lets you repay borrowed money in fixed monthly payments over a set period, making budgeting easier.

These loans are available to a wide range of credit profiles, but borrowers with lower credit scores may face high interest rates. Careful consideration of repayment costs is essential.

Loans to Avoid

Payday, title, and tribal loans often carry very high interest rates and hidden fees, making them extremely risky. While they may seem like a quick solution, these loans can trap borrowers in a cycle of debt.

Single mothers should avoid them and seek safer alternatives whenever possible.

Nonprofit & Emergency Resources

Not every form of support comes from the government. Many nonprofits and community groups step in when you need fast help. These resources can make a big difference during tough times, especially if you’re facing an emergency.

Here are some trusted options you can look into:

- Modest Needs Foundation: Offers short-term grants for urgent needs like rent, medical bills, or utility payments. (modestneeds.org)

- Salvation Army: Provides food assistance, rent and utility help, and seasonal programs like holiday gifts. (salvationarmyusa.org)

- Catholic Charities: Helps with housing, food, and family services across the U.S. (catholiccharitiesusa.org)

- United Way 211: A nationwide hotline and website that connects you with local services, from childcare to housing aid. (211.org)

- Local Charities & Churches: Many offer food banks, clothing drives, and emergency funds. Search “local charities near me” or ask at your community center.

- Charity Navigator Directory: A database where you can find nonprofit groups in your area that focus on housing, food, or family aid. (charitynavigator.org)

- Crowdfunding Platforms: Websites like GoFundMe let you raise money directly from friends, family, or community members. (gofundme.com)

Even small help from nonprofits or community groups can carry you through until more stable support is in place. It’s worth checking a few of these options, because you might find one that matches exactly what you need.

State-Specific & Local Resources

Every state offers its own mix of housing, grant, and loan programs. These resources can be valuable for single mothers who need support beyond federal aid. Below are programs for the ten largest states by population:

| State | Key Programs & Resources | Website |

|---|---|---|

| California | CalWORKs cash aid, CalFresh (food benefits), California Housing Finance Agency (CalHFA) homebuyer programs | ca.gov |

| Texas | Texas TANF, SNAP, Texas Department of Housing Single Family Programs (loans and aid) | tdhca.texas.gov |

| Florida | Temporary Cash Assistance (TCA), Florida SNAP, Florida Housing Finance Corporation | floridajobs.org |

| New York | Family Assistance, SNAP, HomeFirst Down Payment Assistance Program (NYC Housing) | ny.gov |

| Pennsylvania | TANF, SNAP, LIHEAP, Pennsylvania Housing Finance Agency homebuyer programs | pa.gov |

| Illinois | TANF, SNAP, Illinois Housing Development Authority (IHDA) Down Payment Assistance | illinois.gov |

| Ohio | Ohio Works First (cash aid), SNAP, Ohio Housing Finance Agency (OHFA) homebuyer help | ohio.gov |

| Georgia | TANF, Georgia SNAP, Georgia Dream Homeownership Program | georgia.gov |

| North Carolina | Work First Family Assistance, NC SNAP, NC Housing Finance Agency home loan programs | nc.gov |

| Michigan | Family Independence Program (cash aid), SNAP, Michigan State Housing Development Authority (MSHDA) | michigam.gov |

These state-specific programs often add extra support on top of federal aid. Checking your state’s website is the best way to find updated details and apply directly.

Step-by-Step Application Guide

Applying for financial help can feel overwhelming, but breaking it down into steps makes the process easier.

- Gather your documents: Collect proof of income, identification for you and your children, and proof of residency. Having these ready will save time and prevent delays.

- Contact local social services: The Local office can connect you with programs like TANF, SNAP, Medicaid, and housing vouchers. They often provide applications and help you fill them out.

- File the FAFSA for school aid: Complete the Free Application for Federal Student Aid online to apply for Pell Grants and other education support. This step is required for almost all school-based financial help.

- Talk to lenders and housing agencies: For FHA, USDA, or other home loan programs, speak directly with lenders or state housing offices. They can explain your eligibility and guide you through the application process.

Following these steps in order will make applying smoother and increase your chances of approval.

Conclusion

Finding the right financial support can make life more manageable, especially when you’re raising a family on your own.

From housing aid to education funding, the resources available give you choices that match your situation.

Programs like grants, assistance initiatives, and loans for single-mother households are valuable tools when used wisely. The key is knowing where to apply and what works best for your needs.

If you’re ready to keep learning practical solutions and want more guidance, check out my other blogs for detailed tips and fresh ideas to help you stay financially strong.

Frequently Asked Questions

Can single moms get loans with bad credit?

Yes. Credit unions, some online lenders, and installment loan providers may approve small loans, but rates are higher. Compare terms carefully before applying.

Are there emergency cash grants for single mothers?

Yes. Nonprofits, charities, and some state programs offer emergency cash grants for urgent needs like rent, food, or medical bills. These don’t need repayment.

Can single mothers get help with childcare costs?

Yes. Many states have Child Care Assistance Programs, and nonprofits or local churches often provide low-cost or free childcare support to working or studying parents.

Are there programs that help with utility bills?

Yes. The Low-Income Home Energy Assistance Program (LIHEAP) and local charities help cover heating, cooling, or utility costs for families who meet income requirements.