Controlling My Spending w/ Bluebird by American Express

Hear ye! Hear ye! I’ve been eyeing the Bluebird card ever since it showed up in my local Walmart. I admit, it was the color the caught my eye. The blue is so soothing and almost one of my favorite colors.

Why am I so geeked to be telling you about this? Well it’s because I get to work with them silly! Yep, I am working with the Bluebird brand to bring you more information and tips on how to maximize this new card.

If you got my FREE 79 Ways to Turbo Charge Your Financial Life ebook you know that controlling your spending is one of the first things I advise you to do.

I’ll be updating you on the various ways I’m using the card from making purchases for Back-to-school and travel expenses to staying up to date on my account information.

I hope you join me on my journey through the land of no-fee card purchases with Bluebird by American Express. It has all of the premium features that account-holder love, such as deposits by smartphone and mobile bill pay, and no minimum balance, monthly, annual or overdraft fees, purchase protection, roadside assistance, 24/7 customer service, etc.

Registering for My Card

The first step is to register for my card. I went to Bluebird.com and was met with the beautiful blue again. I clicked the Register button and followed the directions.

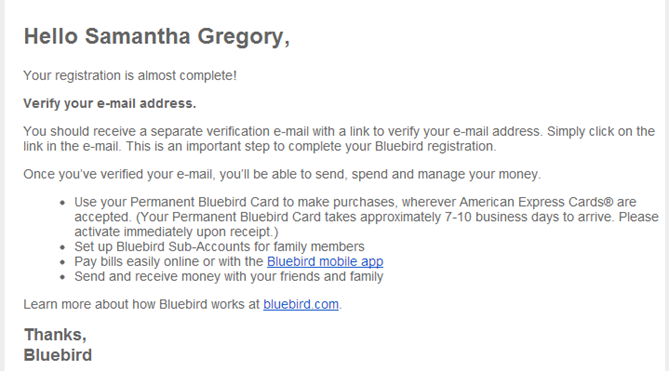

I registered then received this email that it’s almost complete. I have to click the link in a separate email that will verify my email address then take me to my new account.

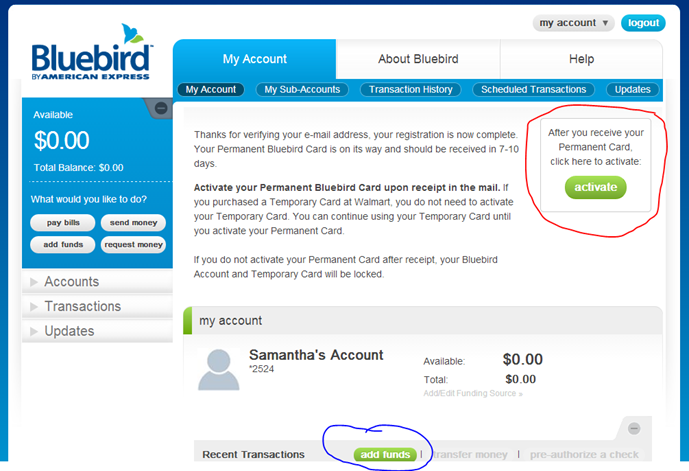

Now my account is all set up. The next step is to add money to my account using my regular checking, savings, payroll check, or check image capture on my smartphone. Of course I can’t use the account until I get my permanent card in the mail. I will have to log back into my account to activate it then I’ll be all set to start spending, monitoring, and distributing money in any sub-accounts I’ve set up.